A company car used for private purposes from the employer’s point of view

The company car usage for private purposes is becoming a more and more frequent topic, especially from the perspective of VAT deduction. Our article will help you to get better oriented and it will also provide some important information along with the practical examples.

Value added tax on the car purchase

If an employer (company) wants to claim a VAT deduction on the purchase of a car, it is obliged to monitor (for the next 5 years after the purchase) whether and in what proportion it is used for private purposes. The five-year period starts with the year when the asset was acquired. The deduction can only be claimed to the extent that the vehicle is used for economic activities.

Since 1st January 2024, the deduction has been limited to M1 cars (maximum 8 seats). If the price of the car exceeds CZK 2 million, it is possible to claim a VAT deduction of a maximum of CZK 420,000 if it is used for economic purposes only.

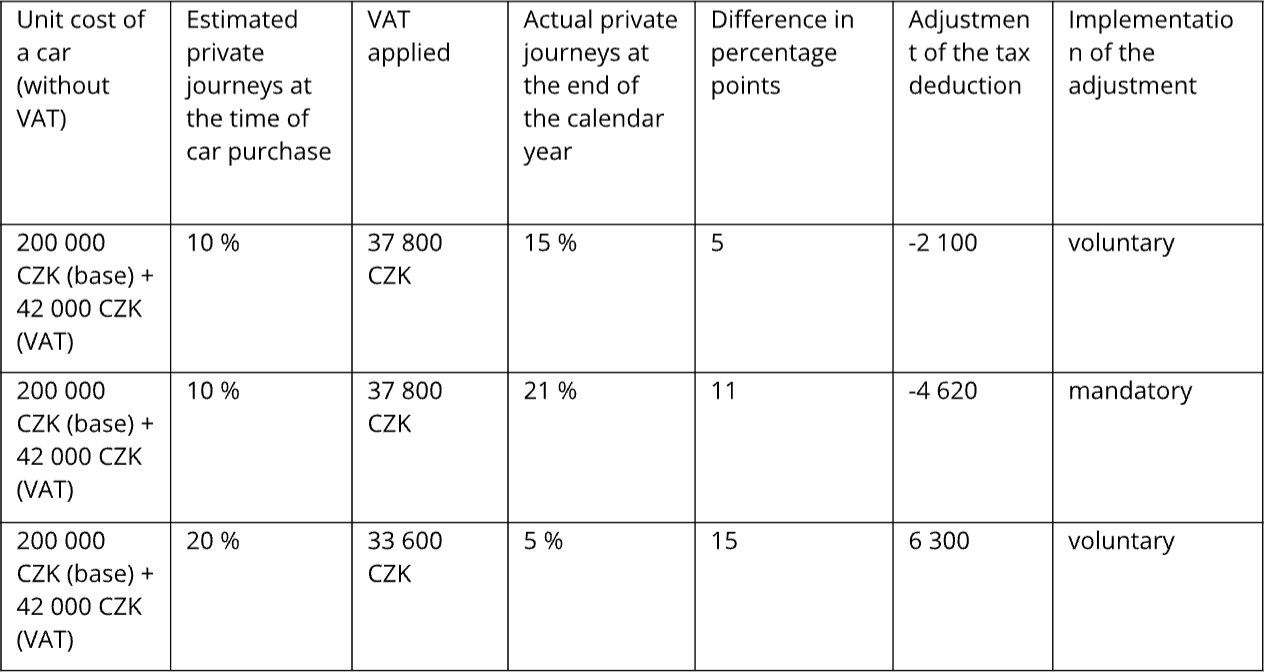

Let’s suppose that the vehicle is also used for private purposes at 20% so we will therefore claim 80% of the VAT on the invoice. At the end of the year, we find out from the logbook that private journeys have actually been 35% of all journeys made with the car, so we adjust the deduction in the last VAT return. This is calculated according to the following formula:

VAT amount applied x (0.65 – 0.80) / 5

The adjustment to the tax deduction should be stated in the tax return on line 60. This is how we will do it for the next 4 years. For the sake of completeness, the deduction is only adjusted if the change in the use of the vehicle is greater than 10 percentage points – if the calculated amount is positive, we are entitled to correct the deduction, but if the amount is negative, we are obliged to make the correction.

This issue is regulated by the Value Added Tax Act § 78 (VAT Act).

Value added tax on car-related documents

The VAT deduction must be pro-rated according to the proportion of business and private journeys. This applies to everything related to the car operation, e.g. repairs, washing, tyre changes, etc.

As stated in the Income Tax Act (ITA) § 75, the coefficient can be determined by a qualified estimate for in-year accounting, but in the last VAT return, the deduction must be adjusted in a similar manner as described above. Again, the adjustment occurs if the change in the use of the vehicle is greater than 10 percentage points and is reported on line 45 of the VAT return.

Income tax

If the employee is taxed on the relevant percentage of the input cost of the car in his wages in accordance with the ITA (§ 6, Section 6), the costs of the car are tax deductible for the employer. Examples of such costs are depreciation of owned vehicles, rental or lease payments, as well as washing, regular servicing, etc. This interpretation is in line with General Financial Department Guideline D-59 on Section 24(2)(26) of the ITA.

The exception is fuel, which is normally tax deductible only to the extent that it is attributable to business trips. An exception to the exception is where it is agreed in writing between the employer and the employee that the employer will pay for fuel for private travel. Then this is also a tax expense – but beware that it is a non-monetary income from employment on the part of the employee.

What to do if you don’t know how to proceed

If you would like to advise in this area or you would prefer us to deal with the legal obligations to deduct VAT on company cars for you, please do not hesitate to contact us.